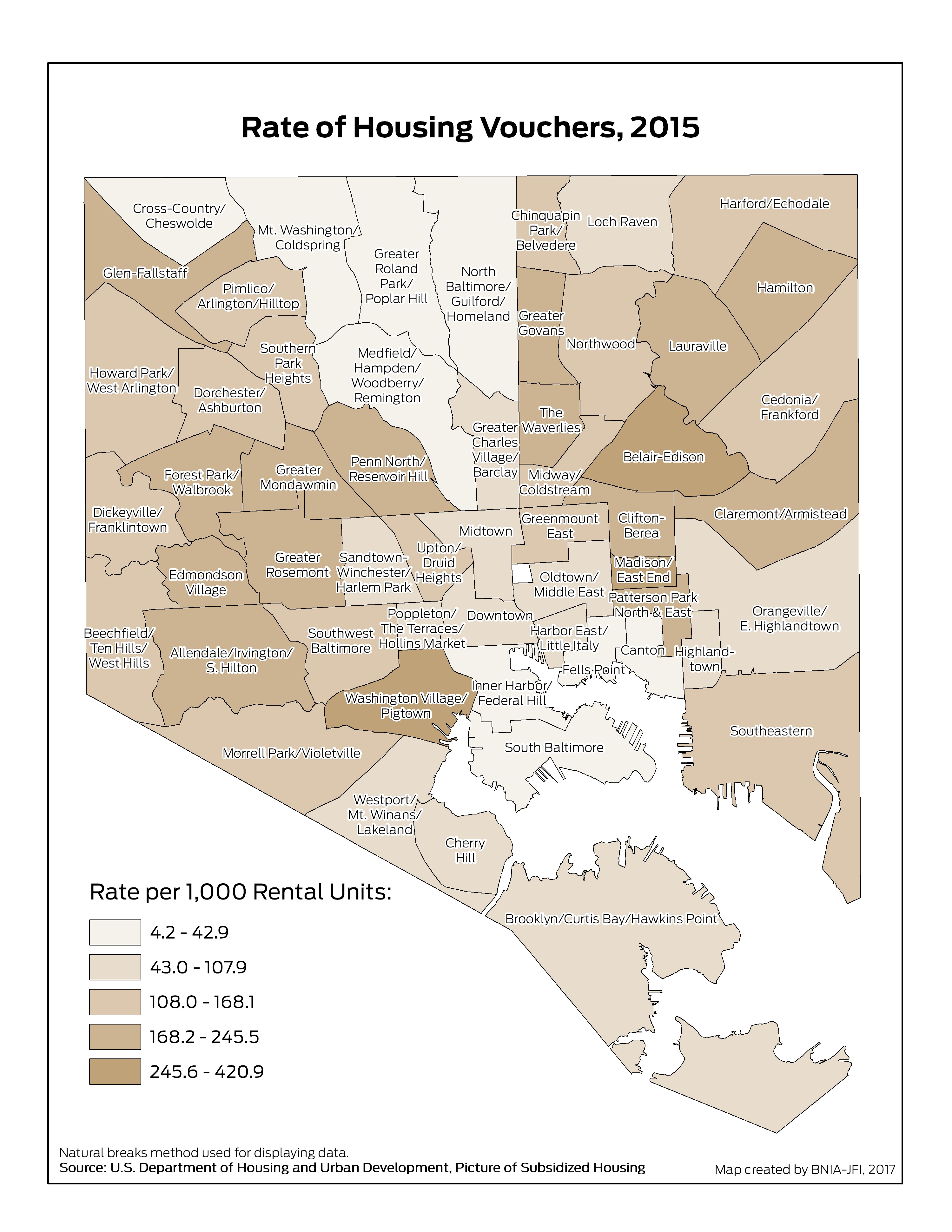

Data from the latest Vital Signs report point to a pretty strange paradox: the top three neighborhoods in Baltimore with high housing voucher use (i.e. households are using a voucher to offset the cost of rental housing) also have the highest percentage of renters spending more than 30 percent of their income on rent. The housing voucher by definition is meant to prevent households from spending more than 30% of their income on rent. So how can it be that high voucher use neighborhoods also have high rent burden?

This paradox is the spatial manifestation of the scarcity economy that is affordable housing in Baltimore. As of 2015, Baltimore had 36,000 units available across all HUD housing programs, of which roughly 16,000 were used by voucher holders. Sounds like a lot; however, also from the Vital Signs report, we know that 19% of Family Households in Baltimore are living below the poverty line–46,000. That means, conservatively, there is a gap of at least 10,000 households that qualify for housing assistance by income alone that are not receiving it. We know that is a conservative estimate, because the current waitlist for housing assistance in Baltimore is 15,000, and the waitlist is closed.

Back to the paradox. The voucher value in Baltimore is set at the Metro Fair Market Rent (See Table below). A family can rent a 2-bedroom unit for up to $1,232.

Final FY 2015 FMRs By Unit Bedrooms

| Efficiency | One-Bedroom | Two-Bedroom | Three-Bedroom | Four-Bedroom | |

| $833 | $985 | $1,232 | $1,574 | $1,713 | |

Because the voucher has the same value anywhere in the city, households with a voucher are welcomed by property owners in neighborhoods that would typically command an equal or often lower rent on the private rental market. These are stable, decent neighborhoods, like Belair Edison and Pigtown. Given the moderately-priced homes, these are the same neighborhoods in which households on the wait list are seeking to rent. There becomes a very localized market pressure among renter neighbors in the same neighborhood, which causes a lot of anxiety particularly for the renters without any housing assistance.

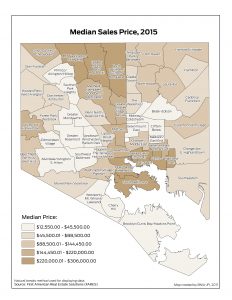

Vital Signs also shows that these neighborhoods have moderately-priced homeownership options, with median sales prices below the citywide average of $125,000 in 2015.

So the combination of these data in the same neighborhoods (high voucher use, high rent burden, and below-average median home prices) point to 3 key recommendations which BNIA-JFI is actively working with advocates and the impacted communities on:

- Baltimore City should adopt the Small Area Fair Market Rent demonstration program with sets rent at median for the zipcode (or even better by the census tract). The housing voucher program should not encourage artificial inflation of existing housing prices in middle-market neighborhoods.

- Only an estimated 1,000 housing vouchers turnover to households on the waitlist every year, which means that the average wait time is 3 years, if a household is lucky enough to get housing assistance at all. We need a pipeline of programs that successfully graduates households from the voucher into homeownership, ideally right in the neighborhood they are already living. Counseling current voucher holders for housing in the neighborhoods they currently live in and ensuring community banks can provide low cost mortgages is needed meets multiple objectives: stabilizes the homeownership market, creates the least disruption for any children in the household attending the neighborhood school, and opens up the voucher wait list to other renters.

- We need programs that address the scale of the waitlist. Getting everyone off the housing voucher waitlist is not only a poverty-alleviation strategy but also a local community- and economic-development strategy. If we used our resources to provide more housing assistance, the vouchers given to those on the wait list would then go to local property owners, who are operating an income-generating business with their properties. Essentially, this expense would be an investment in the city’s real estate in general.

By Seema D. Iyer, PhD.